Why Changing Jobs or Retiring Demands Careful Planning and Expert Insight

Every year, millions of Americans change jobs or step into retirement, yet far too few take the time to fully understand the risks and opportunities that come with these transitions. According to industry experts, overlooking even one small decision during a job change or when planning for retirement can cost you financially in both the short-term and the long-run. Have you ever wondered why some professionals glide seamlessly from one career phase to the next, while others find themselves facing unexpected taxes, lost benefits, or gaps in insurance coverage?

Changing jobs or retiring are some of the most significant financial events in a person's life, often accompanied by excitement, relief, and sometimes a dose of anxiety. But with change comes uncertainty—and missed steps can be costly. People frequently underestimate the full financial impact of moving to a new employer or finalizing their exit from the workforce. Understanding what is at risk, and planning ahead, can help avoid common pitfalls that otherwise lead to costly mistakes. This article will explore what you need to know and which career decisions matter most, so you’re better equipped for whatever professional or personal milestone is next.

Understanding the Impact of Career Transitions: Why Each Choice Matters More Than You Think

The phrase "changing jobs or retiring" may sound straightforward, yet behind it lies a complex web of financial, emotional, and practical considerations. When moving from one employer to another, or stepping back altogether, it's not just a matter of getting a new paycheck or entering a new phase. There are questions about 401(k) rollovers, life insurance coverage lapsing, changes in health benefits, and how these financial details compound over decades. Without thoughtful guidance, even well-intentioned moves can leave you exposed to unexpected taxes, lost benefits, or delays that set back your progress.

Add in the fast-changing landscape of workplace benefits—like the rise of high-deductible health plans, evolving tax laws, or fluctuating retirement account limits—and it's easy to see why overlooking details could create mounting problems. Retirement should be a time of reward for years of hard work, but skipping essential reviews of your retirement plans, or missing the chance to optimize your savings as you change jobs, may turn what should be a triumphant transition into a financial headache. The stakes are higher than most people realize, making it all the more valuable to understand how to avoid these career-altering mistakes.

How Thoughtful Planning When Changing Jobs or Retiring Creates Security and Confidence for Years to Come

Experienced financial advisors have seen firsthand the ripple effect that informed decision-making can have through all stages of a career. Drawing on years in the industry and deep client relationships, seasoned advisors understand that a proactive approach when changing jobs or retiring doesn’t just provide peace of mind in the moment—it establishes a foundation for long-term financial health. When individuals take the time to review their benefits, understand their insurance policies, plan for taxes, and align their investments, they’re able to enter each new chapter with greater confidence.

Successfully navigating a job change or retirement requires more than just reviewing a benefits packet or signing retirement papers. It means identifying opportunities to maximize savings, understanding how tax rules have changed for retirement accounts, and making sure that no important details get overlooked—such as properly transferring a 401(k) or making sure a lapse in insurance coverage doesn’t occur. By staying vigilant and working with knowledgeable advisors, individuals insulate themselves from costly mistakes, allowing them to focus on new opportunities, rather than future regrets.

Thinking Beyond Your Paycheck: Why Holistic Financial Strategies Matter Most During Major Career Moves

Transitioning careers or retiring isn’t just about salary negotiations or retirement party celebrations. The real value comes from a 360-degree evaluation of your financial life, including insurance, investments, taxes, and estate plans. Focusing only on the paycheck can leave gaps that surface years later—whether in the form of higher out-of-pocket health expenses, missed social security optimization, or penalties on retirement distributions.

It's this comprehensive lens—one that considers both near-term and life-long goals—that separates successful transitions from those filled with regrets. Financial advisors who emphasize respect, gratitude, and innovation have guided clients through these changes, helping them to see how even small decisions made today can lead to greater stability and growth over time. Conducting regular reviews of your portfolio, staying abreast of tax code changes, and preparing for volatile market conditions all play a critical role in creating an adaptable plan. The peace that comes from knowing your finances are secure allows you to stay focused on new beginnings instead of past oversights.

Key Retirement and Tax Numbers: Staying Ahead of the Curve as You Change Jobs or Retire

Among the most overlooked aspects when changing jobs or retiring are adjustments to IRS guidelines and tax brackets, which evolve annually. These changes directly impact contribution limits for retirement accounts, how much you can save pre-tax, and what you might owe later. Failing to update your strategies to align with current tax numbers can result in missed savings or unexpected bills, undermining years of patient work.

Timely knowledge of adjustments—such as increased allowable contributions or changes in required minimum distributions (RMDs)—ensures that employees and retirees can optimize every dollar. This is particularly relevant now, as federal and state regulations continue to shift to reflect new economic realities. Those who take the time to understand these details, or work with those who do, can create plans that weather uncertain financial environments and come out ahead.

Preparing for Hidden Pitfalls: How Weather, Insurance, and Unforeseen Events Can Interfere With Your Plans

Unexpected events, such as extreme weather or sudden health changes, can quickly derail even the best-laid retirement or career transition plans. In recent years, insurance companies have tightened their policies, increased premiums, or withdrawn coverage in higher-risk markets. For those changing jobs or retiring, this can mean new vulnerabilities—especially if insurance plans lapse or don't provide the coverage needed for your region and circumstances.

Thinking ahead about how your coverage needs will change, and ensuring policies are comprehensive before making a career move, is an often-overlooked but critical aspect of transition planning. Reaching out for expert reviews of your policies and staying alert to broader economic and environmental trends can keep you financially protected, regardless of what the weather—or life—throws your way.

The Philosophy Behind Effective Career and Retirement Guidance: A Commitment to Gratitude, Respect, and Innovation

Building a strategy for changing jobs or retiring isn’t just about crunching numbers—it’s about values-driven decision-making that puts the client's future first. Advisors recognized for their approach to gratitude, respect, innovation, teamwork, and trust are leading the way, ensuring each step of the process is grounded in clear communication and collaborative planning. This philosophy prioritizes not only the financial success of clients, but also their peace of mind and personal aspirations.

Taking a team-based, respectful approach transforms career transition planning from a solitary, overwhelming task to one enriched with support, expertise, and compassion. By insisting on continuous learning and innovation, advisors are uniquely positioned to provide relevant advice for the contemporary marketplace—even as rules, markets, and client priorities evolve. Their focus on these fundamental values translates into real-world benefits, from personalized financial strategies to comprehensive risk assessments and ongoing education for their clients.

Ultimately, trusted advisors empower individuals to embrace career or retirement transitions as opportunities for growth, security, and fulfillment. They believe in sharing knowledge generously, and in helping others make decisions that are true to their own values, not just the prevailing trends of the day.

What Clients Say About Their Journey Through Job Changes and Retirement Planning

Choosing the right guidance during times of transition can have a profound and lasting impact, as evidenced by the voices of those who have walked the path before. Personal stories from real clients provide valuable insight into the trust and peace of mind that come from thoughtful planning.

I’ve been working with Michael and Mary for many years. Their knowledge and experience provide me with security and peace with my finances. I trust them entirely.

This level of assurance is not uncommon when expertise, experience, and core values come together. Many who make informed choices during periods of change—be it changing jobs or retiring—discover a newfound sense of clarity and freedom, knowing their finances are in wise and trustworthy hands.

Why Avoiding Mistakes During Career Transitions Means a Stronger, More Secure Financial Future

The journey of changing jobs or retiring is often defined by the wisdom of the choices made and the pitfalls avoided. As countless stories and expert insights have shown, a little preparation goes a long way towards safeguarding your financial wellbeing. By understanding the intricacies of retirement accounts, adapting to new tax laws, protecting yourself against unforeseen risks, and choosing partners who operate from a place of gratitude and respect, each individual can step confidently into their next chapter.

The work of skilled advisors—with their commitment to values-driven planning—demonstrates what’s possible when individuals take time to learn, ask questions, and seek expert support. For those approaching a job change or retirement, the right knowledge paired with strategic action transforms uncertainty into opportunity, and worries into well-earned confidence.

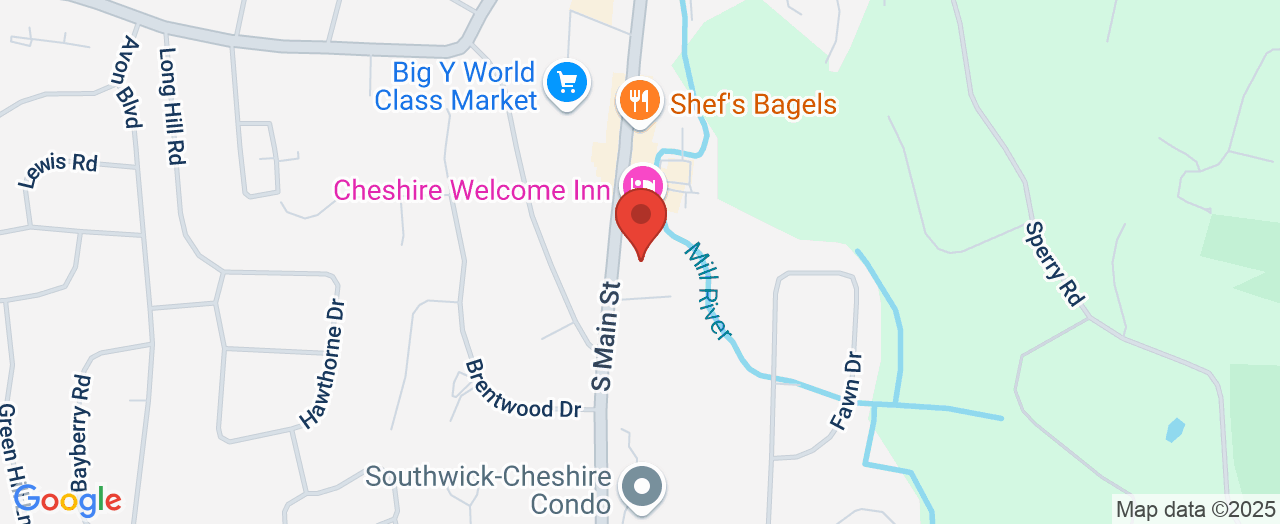

Contact the Experts at EVANS Group Financial Advisors

If you’d like to learn more about how changing jobs or retiring could impact your financial plans, contact the team at EVANS Group Financial Advisors. 📍 Address: 1120 S Main St, Cheshire, CT 06410, USA 📞 Phone: +1 203-439-2600 🌐 Website: https://www.evansgroupfinancialadvisors.com/

EVANS Group Financial Advisors Cheshire Location and Hours

🕒 Hours of Operation:📅 Monday: 9:00 AM – 5:00 PM📅 Tuesday: 9:00 AM – 5:00 PM📅 Wednesday: 9:00 AM – 5:00 PM📅 Thursday: 9:00 AM – 5:00 PM📅 Friday: 9:00 AM – 5:00 PM📅 Saturday: ❌ Closed📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment