Did you know that businesses using professional business valuation methods can sell for up to 20% more than those that don’t? Whether you’re a small business owner eyeing retirement or an entrepreneur preparing for your next big move, mastering business valuation is the single most important factor in maximizing your sale price. This guide will reveal the top methods, surprising valuation truths, and actionable steps to help you command the highest sales outcome possible. Read on to ensure you don’t leave money on the table when selling your business.

Did You Know? Surprising Facts About Business Valuation That Impact Every Sale

- Recent data shows that owners who obtain professional business valuations before selling enjoy, on average, a 15-20% increase in final sale price compared to those who rely on informal estimates. In fact, a majority of closed sales above asking price cite accurate business valuation as a key contributor.

- Many business owners misconstrue fair market value as simply the price they want or need, rather than a figure derived from cash flow analysis and market comparisons. Cash flow—the lifeblood of your business—plays a much larger role in determining value than most realize. Too often, misconceptions about ignored add-backs, unreported revenue, or underestimating the worth of intangible assets lead to undervalued sales and missed opportunities.

Understanding Business Valuation for Maximizing Sale Price

- Business valuation is the process of determining the economic worth of a business by considering a range of factors, including financial performance, industry trends, assets, and cash flows. For business owners, knowing your business’s value is crucial when selling, securing funding, or planning for succession. A properly conducted business valuation ensures you don’t underprice your company—or scare buyers away with unrealistic expectations.

- Imagine two identical small businesses: One has precise, up-to-date valuation reports to justify its asking price, while the other relies on gut feeling. In negotiations, buyers of the first business are more willing to trust the numbers and move quickly, often leading to a faster sale at or above asking price. The second? Protracted bargaining, heavy due diligence, and potentially, a discounted offer due to uncertainty. The right business valuation method transforms uncertain negotiations into confident closings.

While understanding the fundamentals of business valuation is essential, uncovering the lesser-known factors that can influence your final sale price can give you a significant edge. For a deeper dive into these often-overlooked elements, explore business valuation secrets that can further boost your sale price and help you maximize your outcome.

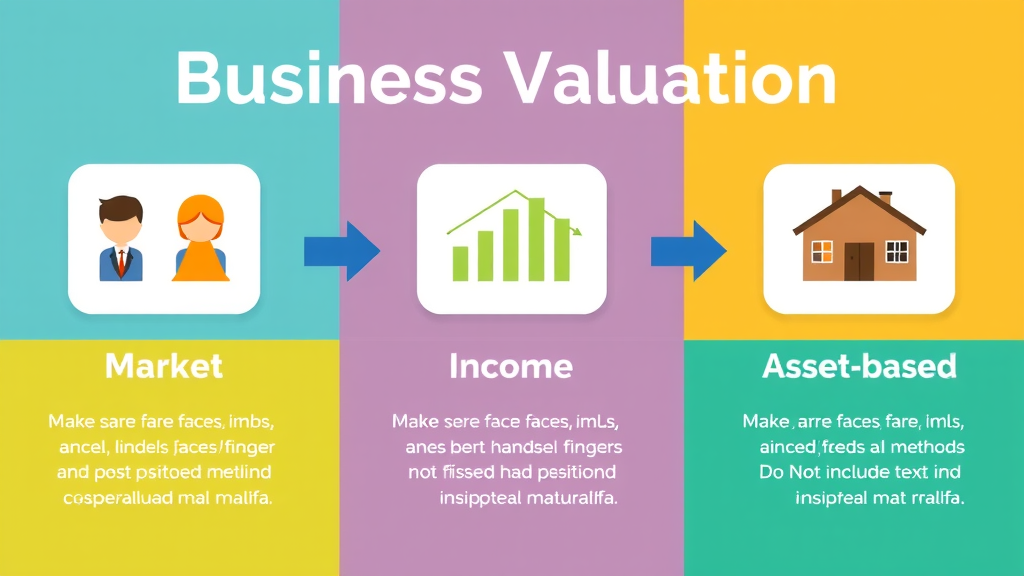

Key Business Valuation Methods Used by Business Owners and Business Appraisers

Market-Based Valuation Method: Comparing Your Business to Similar Sales

The Market-Based valuation method gauges what your business is worth by using recent sales of comparable businesses in your industry and region. Business appraisers analyze market data, financial statements, industry-specific multiples (like price-to-earnings or price-to-revenue ratios), and precedent transactions. This method is especially powerful in providing context for buyers and sellers—giving you a benchmark and helping avoid both overpricing and underpricing. Market-based valuations are often relied upon for small business sales where transparent deal data is available. However, their accuracy depends on robust, relevant comparables and up-to-date market conditions.

For instance, if similar businesses have recently sold for three times their EBITDA or gross earnings, your own financial performance will be evaluated through the same lens. Local market trends, customer base stability, and even intangible assets like branding also play key roles in the final figure. When used correctly, market-based valuation methods offer actionable, real-world benchmarks you can defend during negotiations.

Income-Based Valuation Method: Focus on Cash Flow and Earning Power

The Income-Based valuation method emphasizes cash flow and future earnings potential . It’s highly regarded by buyers seeking returns and by lenders underwriting business acquisitions. This approach involves analyzing your business’s adjusted net cash flow, owner compensation, and one-off expenses to determine its sustainable earning power. Appraisers may use discounted cash flow (DCF) analysis or capitalize on seller’s discretionary earnings to forecast how much income the business will generate moving forward.

What sets this method apart is its focus on risk and reward: higher recurring revenue streams, diverse customer bases, and minimal dependency on the owner result in a higher valuation. Conversely, volatile cash flows or concentration of sales among a small segment of customers can decrease your worth. Income-based valuations put numbers at the heart of negotiations, making your growth, profitability, and risk profile the headline story to prospective buyers.

Asset-Based Valuation Method: Assessing Real Estate and Tangible Assets

The Asset-Based valuation method determines your business’s value by calculating the total worth of its tangible and intangible assets, then subtracting liabilities. Tangible assets include real estate, equipment, inventory, and cash, while intangible assets might cover intellectual property or goodwill. Business owners should provide detailed, up-to-date asset listings with fair market values for an accurate asset-based valuation.

Asset-based methods work best for asset-heavy businesses—such as manufacturing firms, real estate holding companies, or those with significant tangible property on the balance sheet. However, they may undervalue service or knowledge-based businesses where future cash flows and customer relationships carry more weight than physical holdings. Still, thorough documentation of both tangible and intangible assets can reassure buyers and banks of solid underlying business value.

| Valuation Method | Pros | Cons | Typical Use Cases |

|---|---|---|---|

| Market-Based | Uses real sales data; benchmarked to current market conditions; trusted by buyers | Needs access to comparable sales; results can fluctuate by region/industry | Retail, service sector, businesses in active markets |

| Income-Based | Focuses on earnings power; reflects business’s future potential; adjusts for risk | Complex cash flow adjustments; sensitive to forecasting assumptions | Professional services, fast-growth companies, transaction-driven |

| Asset-Based | Clear for asset-heavy businesses; strong for liquidation value; covers tangible assets | May ignore earnings power; undervalues intangible assets | Manufacturing, real estate, distribution, holdings |

Maximizing Value: Essential Steps for Small Business Owners During Valuation Process

- Organize and verify your financial records : Accurate financial statements are the backbone of the valuation process. Ensure your books are clean, reconciled, and reflect true cash flow, including adjustments for owner compensation and one-time expenses.

- Understand adjustments for owner compensation : Buyers—and business appraisers—scrutinize financials for add-backs and non-operating expenses. Adjust your numbers to reflect fair market value, not just tax-minimization tactics. This gives a more honest picture of what the business is worth to a buyer.

- Account for all business assets : Create a thorough inventory of tangible and intangible assets, such as intellectual property, trade secrets, real estate, and inventory. Omissions may result in undervaluation or delayed deals.

- Benchmark using industry ratios and recent sales : Compare your business’s performance to industry standards and recent competitor transactions. This context arms you with defensible numbers during negotiations and helps set realistic expectations for sale price.

Choosing the Right Business Appraiser for Accurate Business Valuations

- Look for credentials and experience in a professional business appraiser. Seek those with accreditation from recognized industry bodies and a solid track record in your industry or business size segment.

- A certified business appraisal not only enhances your business’s credibility with buyers, lenders, and stakeholders—it can also satisfy tax purposes and facilitate smoother due diligence.

- Interview potential business appraisers thoroughly: Ask about their experience with small businesses, specific valuation methods they use, sample valuation reports, and how they address unique industry risks and market conditions. Their expertise can be the difference between a good sale and a great one.

Watch this comprehensive video walkthrough: discover how to collect required documents, work with a business appraiser, understand the parts of a business valuation report, and confidently review the valuation outcome before listing your business for sale.

How Accurate Business Valuation Impacts Deal Structure and Sale Price

- Business valuations directly shape buyer offers and negotiation tactics. With an independent, credible valuation in hand, buyers are more likely to make strong, fair-market-aligned bids. Sellers can contest lowball offers with substantiated data, shifting negotiations in their favor and speeding up deal timelines.

- Valuation results influence deal terms : Details like down payments, earn-outs, and seller financing are structured according to the perceived risk and return embedded in the business valuation report. Higher valuations support more favorable terms for sellers—potentially higher upfront cash and reduced holdbacks—while lower or uncertain valuations may push buyers to introduce risk-mitigation elements such as contingent payouts.

Fair Market Value: The Cornerstone of Every Business Sale

- Fair market value represents the price at which a willing buyer and seller would transact in an open market, without undue pressure. It’s distinct from asset value or book value, which may not account for cash flows or market trends. Understanding the difference allows you to set more strategic expectations for negotiations and deal structure.

- Market conditions, industry performance, emerging trends, and the general health of your customer base all impact fair market value. An upturn in industry demand, favorable economic shifts, or regulatory changes can temporarily boost what your business is worth, while downturns or increased competitive pressures can lower it—even if your underlying financials remain steady.

Advanced Strategies: Improving Your Business Valuation Before You Sell

- Increase recurring revenue streams : Subscription models, service contracts, and long-term agreements enhance cash flow stability—raising your business’s appeal to buyers and boosting valuation multiples.

- Reduce owner dependency : Train staff, delegate operations, and formalize processes so the business can thrive independently. Less reliance on a single person lowers buyer-perceived risk and elevates value.

- Diversify your customer base : Broaden your client roster to avoid overconcentration risk. Buyers want proof that cash flows are resilient even if one or two major customers depart post-sale.

- Address risks tied to real estate or leases : Clarify property ownership, standardize lease terms, and resolve any lingering disputes. Clean, transferable real estate arrangements strengthen negotiations and prevent valuation discounts.

"A well-documented business valuation can be the single biggest factor in achieving a premium sale price. – Leading Business Appraiser"

Learn practical cash flow improvement tactics, from optimizing accounts receivable to renegotiating supplier terms, and see real-life case studies where these changes led directly to increased business sale prices.

People Also Ask: Answers to Top Business Valuation Questions

How do I calculate the value of my business?

- Common methods include applying industry “rules of thumb” (such as a multiple of earnings or sales), simple asset-based estimates, and cash flow analysis. For formal business valuations—especially for deals involving outside investors or lenders—it’s best to engage a professional business appraiser. A certified appraisal leverages market, income, and asset approaches, adjusting for your business’s unique characteristics and growth prospects.

How much is a business worth with $500,000 in sales?

- Applying industry-standard multiples (often 0.5x to 3x revenue, depending on sector, cash flow, and growth), a business with $500,000 in sales could be valued anywhere from $250,000 to $1.5 million. Key variables include EBITDA, debt obligations, tangible assets like real estate, and your business’s cash flow consistency. Professional business appraisers tailor these calculations for greater accuracy by factoring in financial statements and market conditions.

What is the valuation of a company if 10% is $100,000?

- If 10% equity is valued at $100,000, the implied company valuation is $1 million (since $100,000 × 10 = $1 million). However, business appraisers consider if this stake includes control features, special rights, or is part of a creative financing package, which may alter the final fair market value calculation or how the valuation report is interpreted during negotiations.

How much is a business that makes $1 million a year worth?

- Typical business valuation methods might apply 2x to 4x multiples to annual earnings, so a business generating $1 million a year could be worth $2–$4 million. However, the exact worth depends on profit margins, industry benchmarks, real estate holdings, and the consistency of cash flows. Business appraisers make further adjustments to reflect customer base diversity and market trends for a more refined valuation.

Checklist: What Every Business Owner Should Prepare for a Seamless Business Valuation

- Up-to-date financial statements : Balance sheets, income statements, and tax returns that accurately reflect your cash flow and profitability.

- List of all physical and intangible assets : Real estate, inventory, equipment, customer contracts, patents, and intellectual property documentation.

- Organizational structure chart : Clearly defined roles and responsibilities for staff, management, and ownership.

- Growth and risk analysis documentation : Market condition forecasts, customer base trends, and any legal or compliance risks facing the business.

Building Value: Benefits of Professional Business Valuations for Business Owners

- Reach a wider pool of qualified buyers who trust in substantiated business valuation reports, especially for larger transactions, SBA loans, or strategic buyer inquiries.

- Negotiate from strength : Professional reports justify your asking price using fair market benchmarks, cash flow analysis, and industry data—giving you more leverage during negotiations and against buyer skepticism.

- Strategic planning : Use formal valuations to guide business growth, secure financing, or plan succession, enabling you to run your business with clear valuation goals in mind and optimize sale timing.

Delve into how real estate, leases, or property assets factor into business valuations—and why clean, market-aligned real estate records boost buyer trust and transaction speed.

Frequently Asked Questions About Business Valuation

- How often should I revalue my business? Ideally, every 1–2 years, or with any significant event—rapid growth, downturn, ownership changes, or before tax planning and capital raises. Frequent valuations flag risk early and keep you prepared for unexpected sale opportunities.

- Can business owners perform DIY valuations? While business owners can use rule-of-thumb multiples or simple asset reviews, professional business appraisers offer rigorous, unbiased reports that withstand buyer and lender scrutiny. DIY valuations may miss hidden value or expose you to negotiation risks.

- What factors most commonly increase or decrease valuation? Strong recurring cash flows, a diverse customer base, clean financial statements, and transferable processes increase value. Weak documentation, dependent management, customer concentration, or outdated assets reduce it.

Final Steps: How to Use Your Business Valuation to Achieve the Best Sale Price

- Release your valuation outcome strategically : Share it with serious, qualified buyers or use it as part of a controlled auction process. Deliver it as part of a comprehensive information package, including growth plans and risk mitigation measures.

- Leverage your high business valuation in negotiations : Anchor buyer expectations, justify counteroffers, and push for favorable deal structures like higher down payments or shorter earn-outs based on substantiated value.

- Treat your business valuation as a pre-sale improvement roadmap : Identify and address value gaps before listing—clean financials, address risks, and highlight strengths—to both raise your price and increase buyer confidence.

Ready to Maximize Your Business Sale Price? Connect With a Certified Business Appraiser Today

If you’re serious about maximizing your business sale price, don’t leave it to chance. Contact a certified business appraiser now for a tailored, professional business valuation—and take the first step towards a stronger future sale.

As you prepare to leverage your business valuation for a successful sale, consider how working with the right professionals can further streamline the process and elevate your results. Partnering with an experienced business broker can help you navigate negotiations, attract qualified buyers, and ultimately secure the best possible deal. To discover how a business broker can be your strategic ally throughout the sale journey, explore the advantages of working with a business broker for your small business and unlock new opportunities for a seamless, profitable exit.

Add Row

Add Row  Add

Add

Write A Comment