Did you know that over 80% of business sales fail without professional support ? That statistic isn’t just surprising—it reveals the incredible value of the right guidance when it comes to business transfers. Whether you’re buying or selling, the path to a successful ownership change is lined with potential pitfalls. Business transfer agents are the essential navigators through these challenges, turning a process riddled with complexity into an opportunity for success. In this comprehensive guide, you’ll discover why working with transfer agents can dramatically tip the scales in your favor and unlock a seamless transition.

Why Business Transfer Agents Matter in a $4 Trillion Market

- Over 80% of business sales fail without professional support. Explore how business transfer agents can dramatically improve your odds of a successful business transfer.

The global market for buying and selling businesses is estimated at a staggering $4 trillion. Within such a massive landscape, the stakes for buyers and sellers are incredibly high, as any misstep can lead to costly delays or even a failed transaction. Studies show that most business sales collapse in the absence of professional support, often due to miscommunication, insufficient preparation, or legal oversights. That’s where business transfer agents come in—they serve as your experienced co-pilot, ensuring every aspect is handled with the care and expertise necessary for a favorable outcome.

Engaging a business transfer agent is not just about mediating disputes; it's about maximizing value and minimizing risk during a business transfer. For both larger businesses and small business owners alike, having a transfer agent who understands the specific business, industry nuances, and regulatory requirements can make the difference between a seamless transition and a costly misstep. Their involvement is crucial in leveraging networks, evaluating offers, structuring deals, and safeguarding both your investment and your legacy.

"A knowledgeable transfer agent can mean the difference between a seamless business sale and a costly misstep."

What You’ll Gain from Understanding Business Transfer Agents

- How business transfer agents streamline business transfers.

- The differences between business brokers and transfer agents.

- Key steps in the business sale process.

- Qualities to seek in business transfer agencies.

By delving deeper into the world of business transfer agents , you position yourself to avoid common mistakes and navigate the sale process with confidence. You'll learn not only how agents streamline ownership change but also the vital distinctions between business brokers and transfer agents —two roles often confused but with different areas of expertise. We’ll walk through the crucial steps in a successful business sale and uncover the core qualities that separate exceptional transfer agencies from the rest, ensuring you make informed choices every step of the way.

Whether you’re a business owner eyeing your next chapter or a buyer seeking a profitable opportunity, this knowledge is your key to a smooth, high-value transfer. You’ll emerge from this guide armed with actionable insights and a strategic advantage in the highly competitive business transfer market.

As you explore the differences between transfer agents and brokers, it’s helpful to understand how business brokers specifically contribute to stress-free sales and what sets their approach apart. For a deeper dive into the unique value business brokers bring to the table, take a look at this guide on the key role of business brokers in facilitating smooth transactions .

Defining Business Transfer Agents: Who They Are & What They Do

Business transfer agents —sometimes called business transfer specialists or stock transfer agents—serve as highly skilled intermediaries in the buying and selling of businesses. Their responsibilities are broad, ranging from managing transaction logistics to ensuring legal compliance, and they adapt their approach to suit both smaller companies and larger businesses. Rather than leaving you to navigate unfamiliar territory alone, a transfer agent acts as your consultant, representative, and sometimes even negotiator, always keeping sight of your best interests and final objectives.

While they may be mistaken for business brokers , transfer agents have a narrower, more administrative focus, often dealing with the transfer of business ownership records, managing shareholder communications, and facilitating detailed due diligence. Their expertise is invaluable for business owners seeking to keep transitions smooth, fast, and secure, especially when stakes are high and financial, legal, and regulatory standards must be meticulously followed.

Roles of Business Transfer Agents in Business Transfer

- Mediating between buyers and sellers.

- Ensuring legal compliance during business transfer.

- Managing documentation and timelines for business sale.

One of the primary duties of a business transfer agent is to serve as a trusted communicator and facilitator between buyers and sellers . By mediating negotiations and handling conflicts with impartiality, an agent ensures that the sale of the business remains on track—minimizing delays and misunderstandings. Beyond serving as a neutral party, they also maintain a laser-sharp focus on transactional compliance, verifying that every requirement (from financial audits to regulatory disclosures) is thoroughly satisfied before closing the deal.

Documentation is another area where business transfer agents shine. They coordinate all records pertaining to ownership, contracts, licenses, and intellectual property transfers. This careful management protects clients from future disputes and ensures that nothing gets lost or overlooked. Agents also keep rigorous timelines, moving the transaction forward and handling administrative logistics so business owners and potential buyers can focus on the bigger picture.

Transfer Agents vs. Business Brokers: Key Differences

| Aspect | Business Transfer Agent | Business Broker |

|---|---|---|

| Primary Focus | Facilitating shareholder and ownership changes; compliance and documentation | Marketing businesses for sale; matchmaking between buyers and sellers |

| Expertise | Regulatory, legal, and administrative process | Valuation, deal negotiation, sales strategy |

| Typical Clients | Corporations, LLCs, and shareholders | Small to mid-size business owners, entrepreneurs |

| Transaction Types | Stock transfer, equity changes, business ownership disputes | Full business sales, asset sales, franchise resales |

| Involvement Level | Behind-the-scenes facilitator | Direct negotiation and buyer sourcing |

How Business Transfer Agents Facilitate a Successful Business Sale

Successfully navigating a business sale requires more than just finding a willing buyer. It is a complex sale process with many moving parts. Business transfer agents act as experienced guides, drawing on best practices and industry insights to ensure ownership changes are executed smoothly and without surprises. By offering step-by-step support throughout the transaction, transfer agents remove obstacles, protect client interests, and keep the process on schedule—regardless of deal size or industry.

The sale of the business is never a single event but a sequence of coordinated actions, each requiring unique knowledge. From business valuation and confidential listings to buyer screening, negotiations, and handling documentation, transfer agents oversee every aspect. This safeguards both buyer and seller, ensuring the transfer is completed to the highest possible standard and reducing the risk of post-sale disputes or complications.

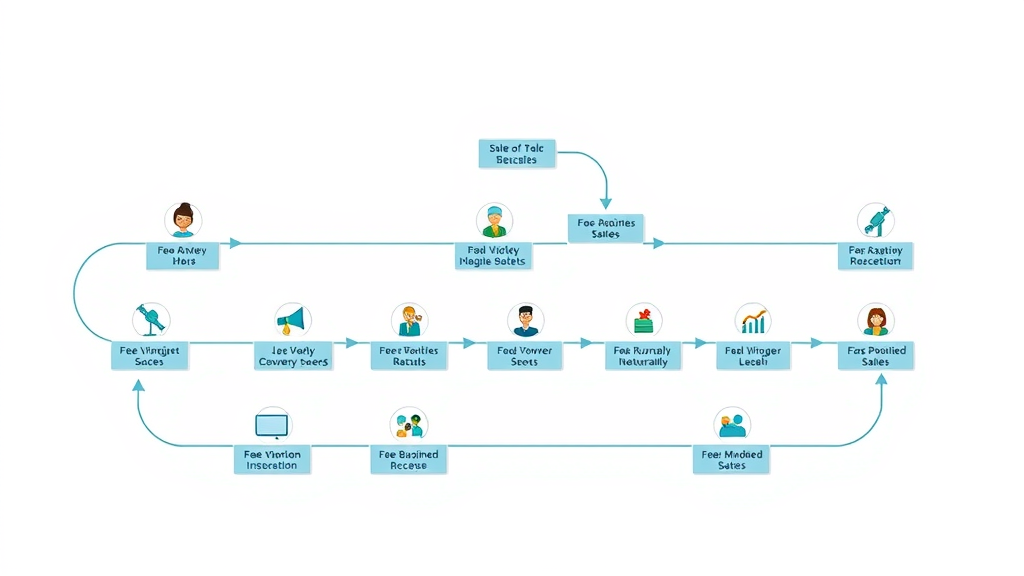

Comprehensive Business Sale Process Overview

- Business valuation by transfer agent.

- Preparation of business for sale.

- Marketing and confidential listing.

- Screening buyers and sellers.

- Negotiating deal terms.

- Managing business transfer documentation.

- Closing the transaction.

A successful business transfer begins with an accurate business valuation , which is critical for realistic pricing and attracting serious, prospective buyers. Once your business is valued, the transfer agent works with you to prepare necessary documents, streamline operations, and make the business attractive to the right audience. Confidential marketing is essential at this stage, keeping sensitive details secure while still reaching targeted buyers and sellers.

After marketing, transfer agents screen all parties, ensuring only qualified buyers or serious sellers progress to negotiations. They then structure and negotiate deal terms, balancing the needs of both sides while protecting your interests. Transfer agents finalize the process by meticulously managing the closing documentation, ensuring that all legal, financial, and regulatory boxes are checked, leading to a successful, official transfer of ownership.

Agency Relationship: Why Choosing the Right Business Transfer Agent Matters

An effective agency relationship is foundational to achieving your business transfer goals. The right agent acts as your trusted advocate, drawing from experience in similar business sale scenarios, anticipating challenges, and confidently guiding you to the closing table. This relationship is built on transparency, ethical standards, and constant communication, ensuring you’re fully informed and empowered to make the best decisions for your future.

"The right agency relationship is an investment in a stress-free business transfer."

When selecting a business transfer agent , it is vital to evaluate both individual and agency credentials. Look for proactive communication, a clear explanation of fee structures (whether a success fee or other compensation), and a proven track record. Remember, your agency relationship shapes your experience, so take the time to partner with a transfer agent who understands your industry, business type, and personal goals.

Transfer Agents’ Networks: Connecting Buyers and Sellers for Optimal Business Transfer

- Benefits of active buyer and seller databases.

- How transfer agents leverage their networks for targeted business sales.

One of the greatest advantages of working with business transfer agents comes from their expansive professional networks. Active databases of buyers and sellers allow agents to quickly match qualified parties, speeding up the process and increasing the odds of a successful transaction. This is especially critical in highly competitive industries or when confidentiality is a priority.

Transfer agents leverage these connections to market businesses directly to relevant investors, entrepreneurs, and companies seeking acquisitions. Their network often includes other transfer agents, business brokers , real estate professionals, and legal experts—creating a holistic support ecosystem for business owners and potential buyers. With these resources, they offer unmatched reach and insider access, carving out faster routes to a sale and negotiating from a position of strength.

Core Qualities of Top Business Transfer Agents and Transfer Agencies

- Industry-specific experience.

- Transparent fee structures.

- Clear communication.

- Ethical standards in agency relationship.

Selecting the right business transfer agent requires more than a favorable personality or a large client list. Top-performing transfer agencies demonstrate deep, industry-specific experience and a thorough understanding of the regulations, challenges, and trends relevant to your particular business. They outline transparent fee structures, discuss whether the compensation is based on a success fee , and avoid hidden costs at every stage of the business transfer.

Integrity, communication, and strict ethical standards are non-negotiable qualities. The best transfer agents provide regular updates, clarify the agency relationship upfront (including dual agency or exclusive representation), and establish clear expectations for timelines and responsibilities. Look for documented past successes: certificates, accolades, and positive testimonials signal a legitimate and respected professional.

Checklist: Steps to Take When Engaging a Business Transfer Agent

- Verify licensing and credentials.

- Check references and past business transfers.

- Discuss the business sale process and timeline.

- Clarify agency relationship terms and compensation.

When beginning your journey toward a business transfer, it’s essential to follow a checklist that ensures you’re working with a reputable partner:

- Verify licensing and credentials – Always confirm your agent’s professional licensing and industry accreditation.

- Check references and completed business transfers – Review their transaction history and ask for references from past clients.

- Discuss the business sale process and expectations – Ask your agent to outline a roadmap including valuation, marketing, and closing timelines.

- Clarify all aspects of the agency relationship and fees – Ensure compensation is clear, whether through a success fee or another model, and document all agreements in writing.

Diligence during this stage builds a solid foundation for a confident, successful ownership change. By working through these steps, you minimize risk and maximize your transaction’s success potential.

Business Transfer Case Study: Success Stories With Expert Transfer Agents

"Our transfer agent came highly recommended, and their expertise delivered results beyond expectations." — Client Testimonial

Consider the case of a mid-sized manufacturing firm that struggled with three previous failed sale attempts. After engaging an award-winning business transfer agent , the business was not only revalued accurately but also presented to a targeted pool of buyers and sellers through the agent's extensive network. The agent streamlined negotiations, resolved last-minute compliance concerns, and managed all documentation. The outcome: a record-time sale at an above-market price, with both buyer and seller praising the seamless, supportive experience.

Stories like these are not outliers. For countless business owners and buyers, the right transfer agent can turn a daunting process into a strategic success—delivering peace of mind and maximizing financial outcomes. Their methods, reputation, and ability to foresee obstacles are what set the best transfer agents apart in the competitive world of business sales.

- Embedded video explaining how business transfer agents manage a business sale from start to finish, featuring real-world examples and success stories.

(Video Embed): For a clear, step-by-step look at what business transfer agents do, watch this real-world walkthrough of a business sale facilitated by leading experts. Insights include how agents handle valuations, navigate negotiations, and leverage their networks for maximum impact. See in action how a professional touch turns complex transfers into straightforward, successful transitions.

- A practical video segment analyzing qualities to seek in transfer agents and business brokers, touching on agency relationships, negotiation skills, and reputation.

(Video Embed): Ready to choose the best agent for your needs? This video unpacks must-have qualities, outlines how to vet agency credentials, and explains why negotiation experience matters. You’ll discover red flags to avoid and insider tips to ensure your business transfer is in the safest hands.

PAA: Who are the top 5 transfer agents?

Answer: Leading Transfer Agents in Business Sale Transactions

- Computershare

- Continental Stock Transfer & Trust

- American Stock Transfer & Trust Company

- Equiniti Trust Company

- Broadridge Financial Solutions

Each of these firms is recognized for their extensive track record in both private and public business transfers , large-scale stock transfers, and shareholder services. These transfer agents have built their reputation by ensuring regulatory compliance, efficient documentation management, and accessible, proactive client service in high-value business sale transactions.

PAA: How do I find a company's transfer agent?

Answer: Methods to Identify a Company's Business Transfer Agent

- Consult official company filings (e.g., SEC reports).

- Check company website investor relations section.

- Contact the company directly.

- Review annual reports or shareholder communications.

To locate a company’s official business transfer agent, investors and business owners should consult regulatory filings—these often list the agent in charge of stock transfer or business ownership changes. Corporate websites (especially in the investor relations area) typically provide clear agent contact details. For private businesses, direct inquiries or annual report reviews are effective ways to confirm the designated transfer agent.

PAA: How do I transfer ownership of a small business?

Answer: Steps to Complete a Small Business Transfer with an Agent

- Engage a licensed business transfer agent or broker.

- Obtain business valuation.

- Prepare and sign a transfer agreement.

- Fulfill legal and regulatory obligations.

- Complete financial settlement and officially transfer ownership to the buyer.

Selling or buying a small business begins with selecting a reputable transfer agent or business broker . Your agent will organize a business valuation and work with you to draft all necessary legal documents. Once all regulatory and financial obligations are satisfied—and the final transfer agreement signed—the agent will oversee the official handover of business ownership to the new party, ensuring every box is ticked for a smooth transition.

PAA: How much do transfer agents make?

Answer: Average Earnings and Fee Structures for Business Transfer Agents

- Typical fee: 5–10% of business sale price.

- Annual salaries can range from $50,000 to $150,000+, depending on experience and transaction volume.

Most business transfer agents work on a success fee model, earning a percentage of the final sale price. This aligns their interests with your success during the business sale . Annual income varies by location, agent experience, and volume of transactions, but industry averages place the range between $50,000 for new professionals and $150,000+ for top earners managing larger deals.

Frequently Asked Questions About Business Transfer Agents

-

What’s the difference between a business transfer agent and a business broker?

A business transfer agent specializes in ownership record management, compliance, and facilitating the transfer of shares or business interests, while a business broker focuses on marketing businesses, identifying buyers, and handling deal negotiations. -

Can transfer agents handle international business transfers?

Yes, many transfer agents are equipped to handle cross-border transactions, navigating international regulatory requirements and coordinating with global legal and financial professionals to ensure compliance and success in international business transfers. -

How long does an average business transfer usually take?

The timeline can vary widely, but most business transfers are completed within six to twelve months, depending on business complexity, buyer readiness, and legal requirements. -

Are business transfer agents regulated?

Yes, most business transfer agents must adhere to strict licensing regulations and industry best practices set by local authorities, financial agencies, or trade associations, providing an added layer of security for buyers and sellers. -

Do I need a lawyer if I have a business transfer agent?

While business transfer agents manage documentation and process logistics, it’s wise to consult a lawyer to ensure legal contracts protect your interests during the ownership transfer.

Transform Your Ownership Change With Leading Business Transfer Agents

- Ready to ensure a successful business sale or transfer? Contact a professional business transfer agent today and start your seamless transition.

Take the next step toward a confident, hassle-free business transfer —connect with a trusted agent and unlock the smooth ownership change you deserve.

If you’re looking to elevate your understanding of the entire acquisition journey and secure the best possible outcome, consider exploring advanced strategies for business buyers. Our in-depth resource on how to seal the best deals during a business acquisition offers actionable insights, negotiation tactics, and expert tips to help you move from a smooth transfer to a truly strategic acquisition. Whether you’re a first-time buyer or a seasoned entrepreneur, these next-level approaches can help you maximize value and minimize risk as you navigate your next business opportunity.

Add Row

Add Row  Add

Add

Write A Comment